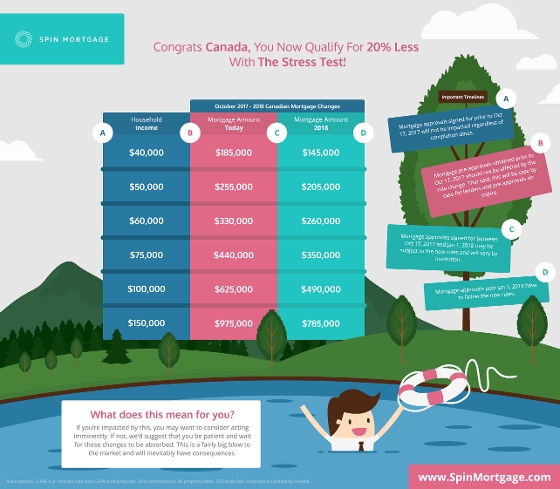

In the Fall of 2016 insured mortgages (less than a 20% down payment) were hit with the stress test, it was announced last week that conventional mortgages (20% or more down payment) will now be stress tested as well!

What is the mortgage stress test?

It means that those mortgage borrowers with a 20% or more downpayment will have to qualify at the GREATER of the Bank of Canada posted rate (currently 4.89%) or the contract rate +2%. This decreases buying power by about 15-20% for those purchasers. The goal of OSFI is to ensure that Canadians can absorb higher payments for potential interest rate increases.

Example:

Today if a client qualified for a mortgage of $500,000, that would be a purchase of $625,000 with a 20% downpayment.

On January 1, 2018 the same client would qualify for a mortgage of about $425,000, which would be a purchase price of about $535,000, with a 20% downpayment.

Stress testing for conventional mortgages will come into effect on January 1st, 2018, however there is still some ambiguity around exact details for dates. As it stands right now if you enter into a deal and have the lender approval prior to January 1st, 2018 you will qualify under the existing rules, even if the deal is completing in 2018. Some of these details are subject to change as more guildelines and regulations are rolled out.

For more details on the impacts this could have on you and our market see the post from Spin Mortgage Here!

.jpg)