Largest Cohort of Millennials Changing Canadian Real Estate, Despite Constraints of Affordability and Mortgage Regulation

National survey shows while the peak millennial dream to own property is very strong, challenges to homeownership vary across the country

TORONTO, August 17, 2017 – According to the Royal LePage Peak Millennial Survey released today, high home values in Canada’s largest urban markets and job uncertainty in other regions mean new strategies and different priorities for ‘peak millennials,[1] a term coined to describe the largest cohort of the millennial demographic and the impact of their potential purchasing power[2].

The article above provides insight into the Peak Millennial demographic, below are some interesting statistics and take aways:

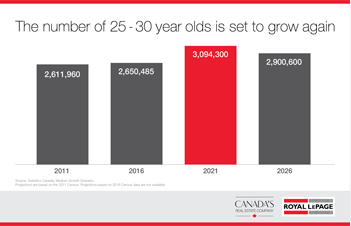

-With peak millennials as a group now reaching their late 20s, the number of people aged 25 to 30 is projected to increase 17 per cent in 2021 compared to 2016.[4]

-The cross-Canada survey conducted by Leger found that 87 per cent of Canadians aged 25 to 30 believe homeownership is a good investment. Yet, while 69 per cent hope to own a home in the next five years, 57 per cent of those surveyed believe they will be able to afford one.

-Thirty-five per cent of peak millennials surveyed already own a home, while another 50 per cent are renting and a further 14 per cent are living with their parents.

-When looking to purchase a property, 75 per cent of peak millennials surveyed would look to use their personal savings for a down payment, with 37 per cent seeking out alternative means of funding as well, like financial support from their families (25 per cent).

-Though 61 per cent of peak millennial respondents across Canada would prefer to buy a detached home, only 36 per cent believe that they will realistically be able to find a property within this market segment.

-64 per cent of peak millennials currently believe that homes in their area are unaffordable, with a significant proportion of respondents in both British Columbia (83 per cent) and Ontario (72 per cent) asserting that prices are simply too high.